The financial implications of divorce are as varied as they are complicated. Among all the assets and liabilities to be divided, how divorcing your partner will affect your student loans is a topic that warrants special consideration. Discover the effects of divorce on student loans with us by examining different scenarios—we’ll provide you with some valuable advice.

Before diving into the intricacies of student loans, you should understand the two ways states handle property division upon divorce.

In the states that adhere to community property ideals, all assets and liabilities acquired during the marriage are deemed community property and are divided equally between the partners. This community property also includes debts, like student loans.

In these states, assets and debts are not automatically divided equally. Instead, the court considers factors such as each partner’s financial situation and the presence of children before making a fair division.

States such as Washington, California, and Texas follow the community property approach, while others, like New York and Massachusetts, opt for equitable division. Understanding debt division in Washington State or your home state is essential to navigating divorce proceedings successfully. Look into your state’s specific laws or consult with an attorney to clarify how divorce will impact your student loans.

When dissecting how divorce will affect your student loans, determine when you took out the loans.

In general, both community property and equitable division states consider premarriage loans to be separate personal liabilities.

If you or your spouse took out loans during the marriage, the court will consider whether these loans were for the couple’s benefit (e.g., if it led to increased earning potential).

If you and your spouse decide to take out loans for further education after separating, this decision will not generally affect the loan payments. Each person will typically be responsible for repaying their own debts.

Having determined how the courts will divide student loans, consider these tips to protect your assets and credit:

The process of divorce can often leave both partners feeling emotionally and financially drained. Nevertheless, knowing how divorcing your partner will affect your student loans can help you confidently navigate this labyrinth. Remember to understand debt division laws in your state and be proactive in managing your financial future.

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com

Latest Posts

Exploring the Biggest Names in Heavy Equipment Suppliers

How To Keep Your Night-Shift Employees Safe

Wedding Budget: How To Create and Stick to One

St. Mary’s Hooks chooses his next chapter

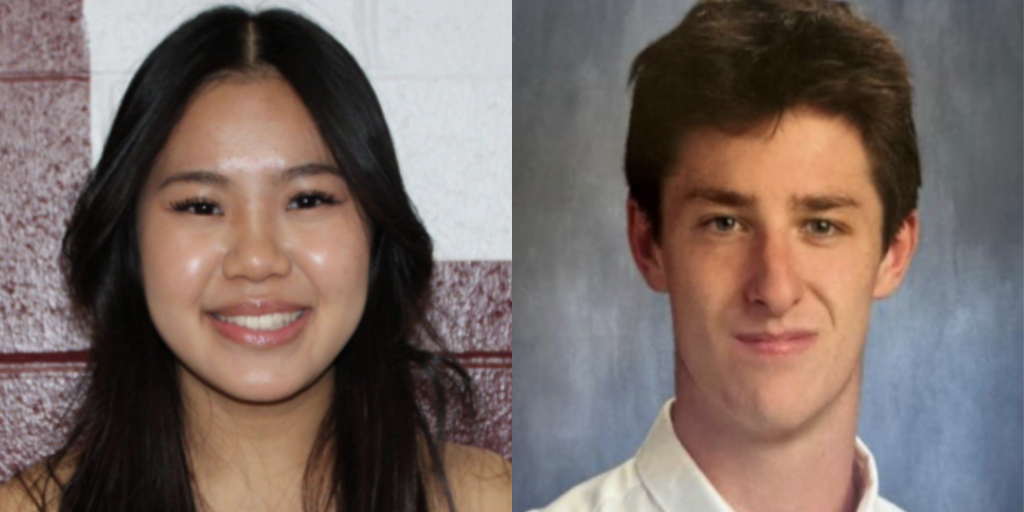

Athlete of the Week – Oluchi Okananwa

English’s Ly, McHale receive scholar-athlete honors

Letters to the editor: Seriously?

Editorial: Greenport is bellwether for regional issues

Blotter: 100 mph motorcycle ride, unlawful fleeing the police

Today’s page 1 3-23-2024 – Itemlive

Suspect in Lynn Pizza Hut shooting arrested in Florida

Jim Tobin receives NEPGA Youth Player Development Award